What are your IP assets worth?

In the 1880s, Thomas Edison used his patent of the electric light bulb as collateral to secure the capital for the foundation of General Electric. There is no question that patents have become one of the leading sources of wealth globally. So, let us talk about assets for a moment, particularly intangible ones, which can provide long-term benefits to a business.

You might have seen some of these figures in 2018 when Aon and the Ponemon Institute analyzed the value of intangible and tangible assets of S&P 500 over nearly four and a half decades. Today, tangible assets like real estate and equipment comprise just 16% of company value, while intangible assets, such as IP rights and reputation, make up 84%. In only 43 years, intangibles have evolved from a supporting asset to a primary consideration for investors.

Over recent years, patent-backed deals have been established through different financial vehicles, from commercial banks to specialized economic operators. While the demand for IP asset-based securities might be small due to the buyers' and sellers' limited universe, the recent proliferation of IP exchanges on the Internet is a promising indicator. The development of greater interest and capacity to use IP assets for financing startups and expansion is only a matter of time — opportunities will increase drastically, together with improved IP-generated cash flows.

Over recent years, patent-backed deals have been established through different financial vehicles, from commercial banks to specialized economic operators. While the demand for IP asset-based securities might be small due to the buyers' and sellers' limited universe, the recent proliferation of IP exchanges on the Internet is a promising indicator. The development of greater interest and capacity to use IP assets for financing startups and expansion is only a matter of time — opportunities will increase drastically, together with improved IP-generated cash flows.

Impact of COVID-19

In the last few weeks, if not months, many companies have faced deplorable trading conditions, with permanent revenue loss and sudden, unforeseen liquidity distress. SMEs and small enterprises are likely to have much lower cash reserves and less access to credit lines, and it has become evident that those companies have to look for a new way to generate short-term funding.

Having a good understanding of your IP assets' actual monetary value can help you use them as collateral for a loan and in many other business decision scenarios. For example, in the case of mergers and acquisitions (M&A) or joint ventures (JV), it is essential to understand the fair market value of the technology part you are going to purchase. Furthermore, during a valuation, the targeted IP assets are put under a magnifying lens, revealing unnoticed investment opportunities, development possibilities, but also unknown risks.

Quantitative valuation techniques

There are three most common and accepted quantitative valuation techniques: the cost approach, the market approach and the income approach. Each has its strengths and weaknesses that more or less adapt to the specific circumstances of the job at hand. The costs involved in developing intangible assets are the focus of a cost-based valuation model. It measures the value of the property related to the expense of making or purchasing the asset. The cost-based model is usually backward-looking and generally fails to address that particular asset's potential future economic benefits.

A market-based valuation model estimates the value of IP assets by looking at the marketplace, but the appropriate choice of a comparable intangible asset can be a significant problem. The income-based valuation models make use of forecast future revenues to develop a current estimate of asset value. Under this valuation model, an intellectual asset's value is primarily established by the royalty revenue in a licensing structure. These models adopt a forward-looking perspective, estimating future earnings derived from the commercial use of intangible assets. If available, it is better to use actual data or historical results than rely on assumptions. Unfortunately, that is not always feasible. However, it is possible to warrant that any assumptions made are based on the financial, market, economic and competitive characteristics in place during the analysis' time frame.

Context in judging value

As well as a solid grasp of the unique characteristics of the IP under consideration, selecting the proper methodology relies on a thorough understanding of the valuation context and of the researched business environment. By correctly designing the valuation analysis, it is possible to provide a calculated answer to any question associated with the IP value, whether it addresses the level of damages related to patent infringement or the price to pay for a patent. Ultimately, in all cases, context is the primary judge of value.

Filed in

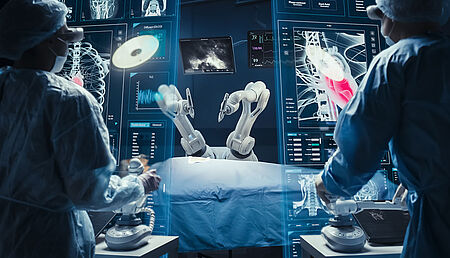

Take an in-depth look at medical devices and how IP will foster, inform and protect more innovative healthcare experiences.